Build versus buy SaaS platforms challenge old-school thinking on technology

Read the article below or download the PDF version here.

Background

After assessing the total cost of internal resources required to address data quality and transformation to ensure the data is fit for purpose, a global hedge fund aimed to reduce the total cost of ownership for key historical market data. The initial target was to save at least $2m after optimizing the data operations and support team.

The financial target would be achieved by effectively managing multiple sources of historical market data and integrating alternate data, more efficiently and accurately. This would not include the productivity benefit of the quantitative analytic team spending far less time on data wrangling and more time assessing current trading strategies and creating innovative new strategies to ensure consistent growth in trading returns.

Client Situation

The hedge fund has multiple offices worldwide using a mix of overlapping data feeds. Proprietary feed handlers collect historical tick data from major exchanges for primary analysis, with licensed tick data as a secondary source to monitor the performance of existing trading strategies and models.

The fund had two key challenges:

- Developing, backtesting and simulating new trading strategies in emerging markets and asset classes the fund did not actively trade and;

- The integration of multiple sources of historical tick data and the increasing number of alternative data for existing and new markets.

While each office had differing data requirements based on trading in different geographies and asset classes, there was a common need to integrate multiple tick data sources with alternate data across all analytical teams. These teams used a variety of cloud-based platforms and analytic environments.

The fund had licensed data from multiple market data vendors and, in many cases, had duplicate data feeds into multiple platforms.

A recent licensing of tick data had caused significant issues with data access, curation and overall quality. Senior analytical and data operations resources were forced to complete extensive data wrangling in order to organize the data and make it fit for purpose, reducing the time available for value creation activity

Solution Overview

RoZetta’s solution to this challenge is DataHex, a cloud-based SaaS market data management platform that is data source agnostic. DataHex integrates multiple sources of trading data into a single platform with a single normalized data architecture.

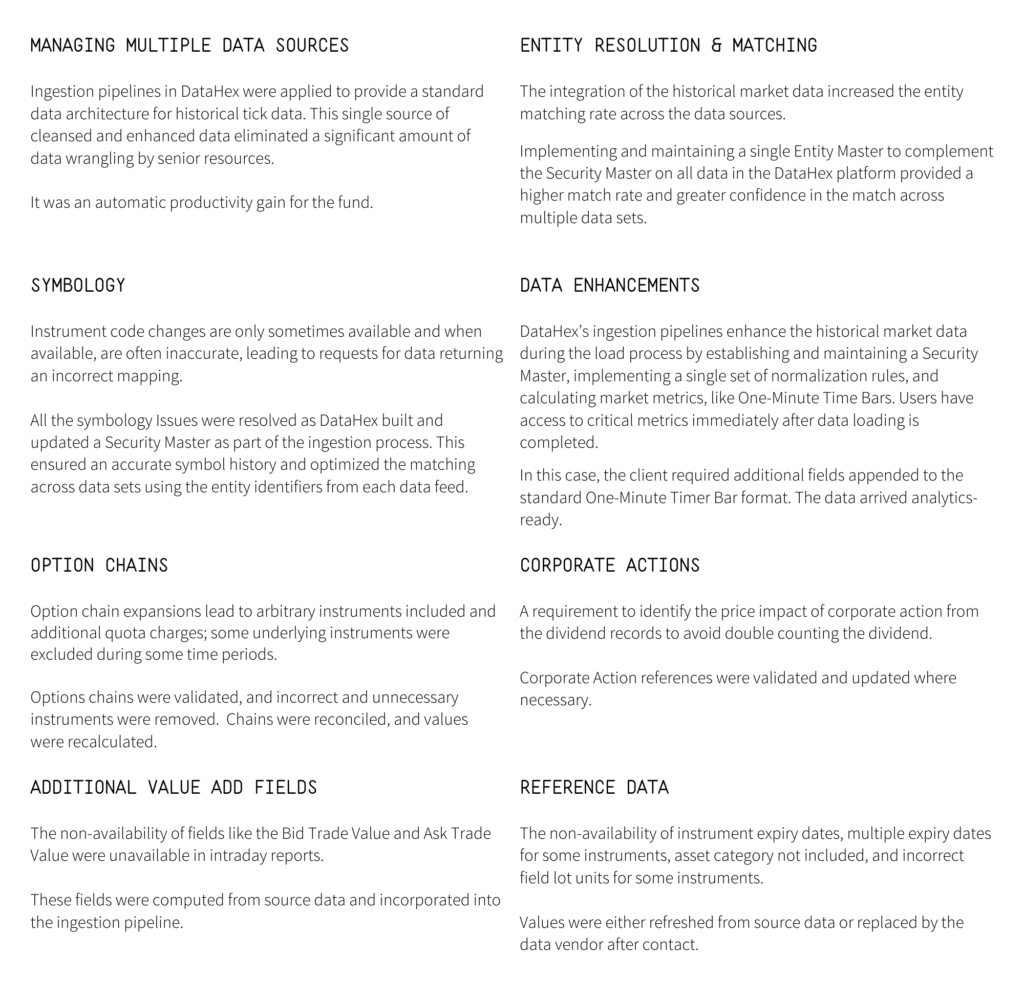

These were the major issues resolved once the client leveraged the DataHex SaaS platform which included:

The Client Outcome

The Client Outcome

Implementation of the DataHex solution would exceed the targeted savings by more than 20%. It is estimated that a productivity gain of 30% – 40% for senior analysts will boost the capacity of the fund to develop new trading strategies.

Further, numerous case studies show that passive management of data vendors leads to duplicated data licensing, further compounded by repeatedly fixing core data issues by many users. These data fixes are typically not socialized across a common platform or fed back to data vendors to remediate at the source. DataHex’s ability to address data quality issues and transform data extracts to multiple cloud platforms and analytical tools formats was a real game changer for the client.

About RoZetta Technology

RoZetta Technology’s core belief is that fusing data science, technology, and data management is the path that amplifies human experience and knowledge. RoZetta’s DataHex cloud platform enables organizations to accelerate speed to market insights and then create value by encouraging data-driven decision-making.

RoZetta brings proven capability, experience, and a mindset to develop products and systems that resolve these challenges to create value. Blending data science, data engineering, and domain knowledge, RoZetta has a proven track record of exceeding clients’ expectations.

Your Productivity Challenge

RoZetta has developed a model that estimates the value of moving to our cloud-based data management model. With very few inputs RoZetta can provide an estimate of the financial gain based on moderating operational costs, vendor management, increased productivity and increasing revenue growth opportunities.

Contact us today to learn how we can enhance your productivity and overall data management efficiency.