Harnessing AI and ML to Transform Fixed Income Markets – Opportunities and Challenges

Read the press release below or download the PDF version here.

Overview

The bond market is being reshaped by the power of Artificial Intelligence (AI) and Machine Learning (ML), offering unprecedented opportunities to enhance accuracy, efficiency, and scalability in bond pricing and valuation. This report delves into the diverse applications of AI and ML techniques within this domain, exploring their potential to transform how fixed-income securities are priced and managed.

However, this transformation also brings challenges. We examine the potential pitfalls of AI and ML in bond pricing, including bias, opacity, and the risk of amplifying market volatility.

Finally, we highlight how next-generation AI and ML are addressing these concerns through explainable AI (XAI), bias mitigation techniques, and hybrid models with human oversight. By navigating these complexities, the financial industry can harness the full potential of AI and ML to create a more efficient, transparent, and robust bond market.

Importance of bond pricing pre and post-trade

Pricing fixed-income securities accurately and frequently is critical to the transparent functioning of the financial markets. Beyond a limited universe of liquid benchmark government and corporate bonds that trade on venues or exchanges and have a reported trade price, the majority of outstanding bonds are illiquid and do not have a recent trade price. These instruments require frequent valuations to ensure pre- to post-trade market participants can assess value for use cases across research, investing, risk management, portfolio performance, fund reporting and accounting.

There are a number of complex variables required to value illiquid bonds. These include the modelling and understanding of credit risk, market liquidity, interest rate volatility, market sentiment and complex cash flow and legal structures. Fragmented and inconsistent data sources, flawed model assumptions and input interpretation can increase mispricing risk and discrepancies. Bond mispricing risks not only impact capital allocation, portfolio valuation and risk management leading to liquidity shortfalls, trading losses and impacting profits but risk breaches of regulatory compliance and fiduciary duty, leading to fines and sanctions as well as risk of legal action for negligence or fraud.

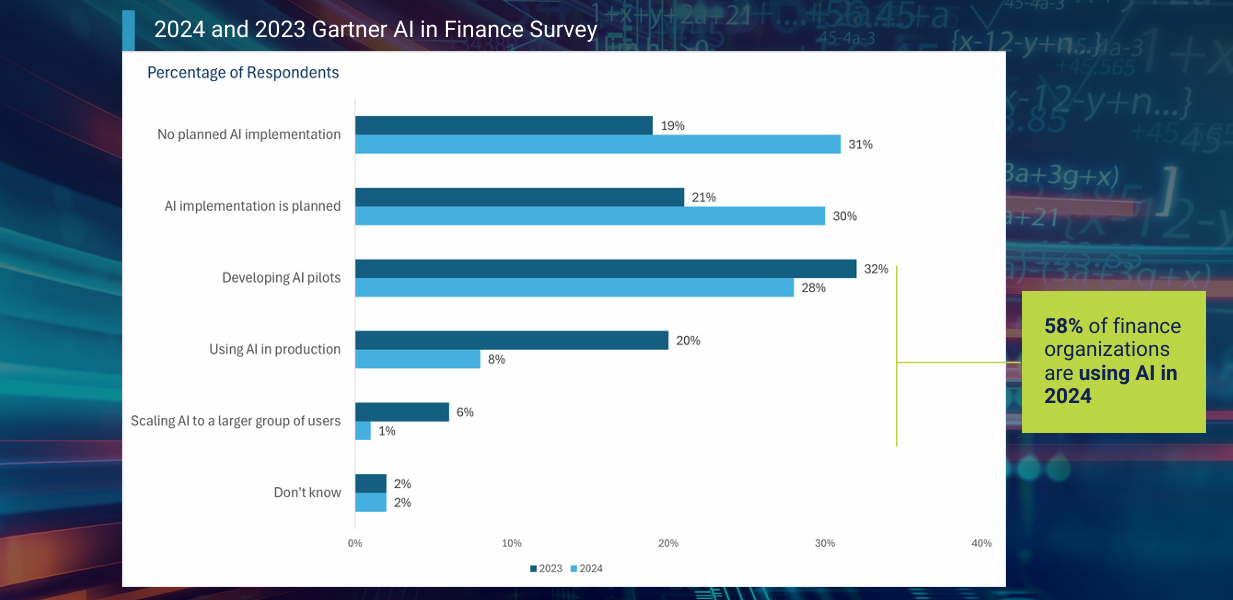

The Growing Role of Artificial Intelligence and Machine Learning in Financial Markets

The pricing and valuation of fixed income instruments have historically relied on complex models, extensive data analysis, and often manual processes. The advancement of low-cost computing has revolutionised the use of Machine Learning (ML) for predictive modeling and Artificial Intelligence / Large Language Models (AI / LLM) for automating processes. The use of AI and ML technologies offers unprecedented opportunities to improve efficiency, accuracy and scalability when applied to the valuation of large numbers of instruments. As with any transformative innovation, AI and ML methods introduce unique challenges and risks. Below is an exploration of the evolving role of AI and ML technologies applied in bond pricing, highlighting their benefits and potential pitfalls.

Artificial Intelligence Overview

The Evolution of Bond Pricing: The Role of AI & ML

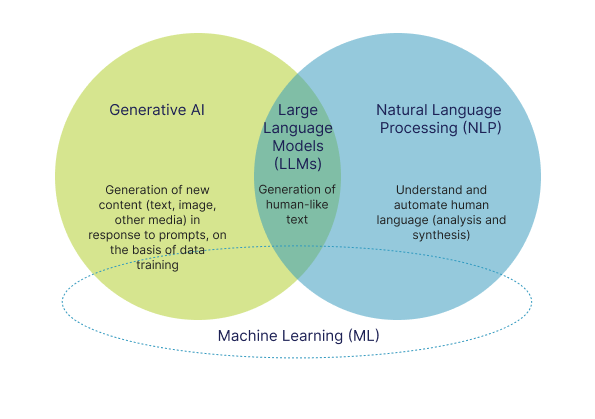

Together ML and AI capabilities are driving innovation in bond pricing, offering powerful tools to enhance decision making, optimise strategies and streamline processes across a wide and complex asset class. These technologies provide users with the ability to digest and process vast datasets efficiently and at low cost, enabling real-time predictive pricing and comprehensive scenario analysis based on large volumes of historical data. While often used interchangeably, AI and ML differ in their capabilities and applications, making it worthwhile to distinguish between them and explore their use cases.

Artificial Intelligence tools, such as natural language processing (NLP), large language models (LLMs), and behavioral modeling, are designed to understand, generate, and discover complex, often non-linear patterns in data. In bond pricing, AI can be applied to tasks such as market sentiment analysis, identifying liquidity shortfalls or surpluses, and analysing news and data flows to develop tailored trading strategies. Additionally, AI can simulate large-scale market behaviors using synthetic agents and persona modeling, offering insights into potential trading scenarios and outcomes.

Machine learning, as a subset of AI, typically employs algorithms and statistical techniques to identify patterns in data and iteratively improve performance on specific tasks. While ML often involves predefined model structures such as regression, decision trees, and clustering, it also encompasses more advanced approaches like neural networks, which are capable of capturing non-linear relationships and powering complex AI systems like LLMs. Together, AI and ML provide complementary capabilities for extracting insights and driving automation in data-intensive domains.

Usage of these methods enhances accuracy and efficiency by quickly processing large datasets. In bond pricing, ML is applied to tasks like analysing macroeconomic data, credit events, corporate actions and pricing trends to forecast interest rates, construct yield curves and predict liquidity. Supervised learning and regression models further enable the creation of highly accurate predictive pricing frameworks.

Key Use Cases of AI & ML in Bond Pricing

Predictive Analytics for Interest rate, liquidity, and credit risk:

ML models, such as supervised learning and deep learning, are transforming bond pricing by providing powerful tools to analyse data, predict prices and forecast rate movements.

- Interest Rate Predictions: Time-series forecasting techniques like ARIMA (Autoregressive Integrated Moving Average), LTSM ( Long Short-Term Memory), and Prophet modeling for trends, seasonality and capturing the impact of events are applied to predict future interest rate movements. These models analyse historical interest rate data, economic indicators and central bank policies to generate forecasts about future interest rate changes which are a crucial variable for bond pricing.

- Credit Risk Assessment: Machine learning models, including decision trees, random forests and neural networks are used to estimate credit risk by analysing financial ratios, debt levels and macroeconomic conditions. By leveraging historical bond default data the models assess the likelihood of issuer defaults and adjust bond pricing accordingly for credit risk.

Forecasting liquidity and analysing trading patterns: Liquidity is a key factor in pricing bonds. AI and ML tools can analyse transaction volumes and market conditions to predict future liquidity levels and incorporate this into bond pricing models. Linear and ridge regression model techniques can be used to forecast liquidity risk. Sequential recurrent neural network models such as LTSM (Long Short-Term Memory) can be used to analyse sequential data and predict future trading volume. Ensemble methods such as the use of XGboost provide accurate predictions of liquidity levels. Reinforcement learning and supervised models can be used to model dynamic bid-ask spread adjustments based on market conditions, demand and risk factors.

Yield Curve Forecasting:

Forecasting yield curves is a cornerstone of bond pricing as it provides insights into interest rate trends and helps price government bonds, corporate debt, and other fixed-income securities. AI’s ability to continuously adapt to new data ensures that yield curve forecasts are both timely and accurate. Leveraging AI and ML techniques significantly enhances the accuracy and adaptability of yield curve predictions compared to traditional models.

- Yield Curve Construction: Machine learning models can incorporate a broad range of variables, such as macroeconomic indicators, trade volumes, and liquidity metrics, enabling more comprehensive and precise yield curve estimation. Again, ensemble methods such as random forests, decision trees and XGboost and Gradient Boosting techniques improve prediction accuracy.

- Monte Carlo simulations for complex securities: Monte Carlo simulations, when augmented with AI-driven techniques such as reinforcement learning, neural networks, or advanced stochastic modeling, enable more precise parameter optimisation for pricing complex securities, including mortgage-backed securities (MBS) and bonds with embedded options. These simulations facilitate the identification of intricate variable interactions and patterns, while also enabling robust scenario testing under diverse market conditions, improving accuracy in risk assessment and pricing strategies.

Clustering and Sentiment Analysis:

AI and ML techniques are transforming bond pricing by leveraging NLP and clustering algorithms. These tools enable rapid analysis of vast amounts of data, uncovering insights that drive more informed pricing decisions.

- Sentiment Analysis: AI-driven sentiment scoring combined with predictive analysis can evaluate sentiment’s influence on pricing dynamics. Analysis helps gauge market sentiment by processing sources of financial news, social media, and analyst reports. NLP models, such as BERT (Bidirectional Encoder Representations from Transformers), GPT (Generative Pre-Trained Transformer), and VADER (Valence Aware Dictionary and sEntiment Reasoner), assess how sentiment around an issuer or the broader market is shifting. This insight can inform pricing decisions in real-time. Negative sentiment about a company’s financial health could indicate increased credit risk, leading to lower bond prices.

- Clustering and Pattern Recognition: Clustering techniques are widely used to group bonds based on attributes such as maturity, coupon rate, credit rating, and liquidity. This helps uncover bonds with similar risk profiles but significantly different yields, enabling analysts and investors to detect pricing anomalies or identify undervalued/overvalued instruments relative to their peers. Typically, unsupervised learning methods are employed for clustering. Popular techniques include: K-Means Clustering, Hierarchical Clustering, Gaussian Mixture Models (GMM), Spectral Clustering, DBSCAN (Density-Based Spatial Clustering of Applications with Noise), and Self-Organizing Maps (SOM).

Pricing automation and Portfolio Optimisation:

AI and ML can enhance and automate the process of bond pricing and portfolio management by continuously analysing incoming data (market prices, yields, credit spreads, economic indicators) and making dynamic real-time pricing adjustments. This is especially valuable for high-frequency trading or market-making in fixed income markets.

- Price predictions: Machine learning algorithms, including deep learning models, are particularly effective at identifying complex, non-linear relationships in pricing data that traditional regression models may fail to capture. By training on historical data, these models improve the accuracy of price predictions and can offer deeper insights into factors such as credit risk and market dynamics. Algorithmic trading strategies can integrate price prediction models to identify inefficiencies in bond pricing and execute trades that enhance portfolio performance. Additionally, reinforcement learning models, such as Q-learning and deep Q-networks (DQNs), are increasingly used to develop automated trading strategies that adapt to real-time market conditions, optimising decision-making in dynamic environments. sdfsdfsfsdfsdfsdfsdfsdfsdfsdfsdfsdfsfsdfsdfsdfsdfsdsdfsdfsdfsdfsdfsdfsdfsdfsdfsdfsdfsdfsdfsd

- Portfolio optimisation and balancing: AI-driven portfolio optimisation models enable portfolio managers to construct and rebalance bond portfolios to achieve specific risk-return objectives. Machine learning algorithms are particularly valuable for evaluating multiple factors—such as yields, credit risk, duration, and liquidity—helping investors build optimised bond portfolios tailored to their investment goals. Reinforcement learning models can dynamically identify optimal trading and rebalancing strategies, allowing portfolios to adapt to evolving market conditions in real time. Traditional techniques, such as Markowitz mean-variance optimisation, remain integral for balancing risk and return, while multi-factor analysis (e.g., accounting for yield curve shifts and sector influences) and advanced approaches like genetic algorithms provide robust tools for selecting portfolio components and enhancing diversification.

Stress Testing and Scenario Analysis

AI and ML models are transforming stress testing and scenario analysis by enabling more precise and dynamic evaluations of bond portfolio performance under various economic and market conditions.

- Scenario Analysis: Scenario Analysis: AI and ML models are instrumental in simulating various and diverse macroeconomic scenarios—such as recessions, inflationary pressures, or shifts in credit spreads—to evaluate their potential impact on bond prices and portfolio performance. These simulations enable portfolio managers to anticipate and prepare for a range of market conditions. Key AI and ML techniques used in scenario analysis include:

-

- Dependency Modelling with Copulas: Captures complex relationships between variables, such as interest rates and credit spreads, allowing realistic multi-variable simulations of economic and market conditions.

- Generative Models (e.g., GANs): Generate synthetic data to simulate extreme or rare market scenarios, enhancing scenario coverage beyond historical patterns.

- Bayesian Networks: Model probabilistic dependencies between economic indicators to provide dynamic insights into how shifts in one variable (e.g., inflation) might cascade through the market. fsdfsfsdfsdfsd

- Stress Testing: Stress testing involves evaluating bond portfolio performance under extreme, adverse scenarios to identify vulnerabilities and ensure robustness. This process often involves repeated sampling across a wide range of hypothetical conditions to measure risk exposure and potential losses. Common AI and ML methods in stress testing include:

-

- Monte Carlo Simulations: Generate repeated random samples of market variables, enabling robust evaluation of bond performance under diverse stress conditions

- Reinforcement Learning: Identifies optimal hedging or rebalancing strategies during stressed conditions by simulating portfolio adjustments in response to evolving risks.

- Extreme Value Theory (EVT): Models tail risks, focusing on rare but impactful events like severe credit downgrades or interest rate shocks.

- Decision Trees and Random Forests: Identify key drivers of risk by evaluating bond performance across multiple stress scenarios with hierarchical decision-making models.

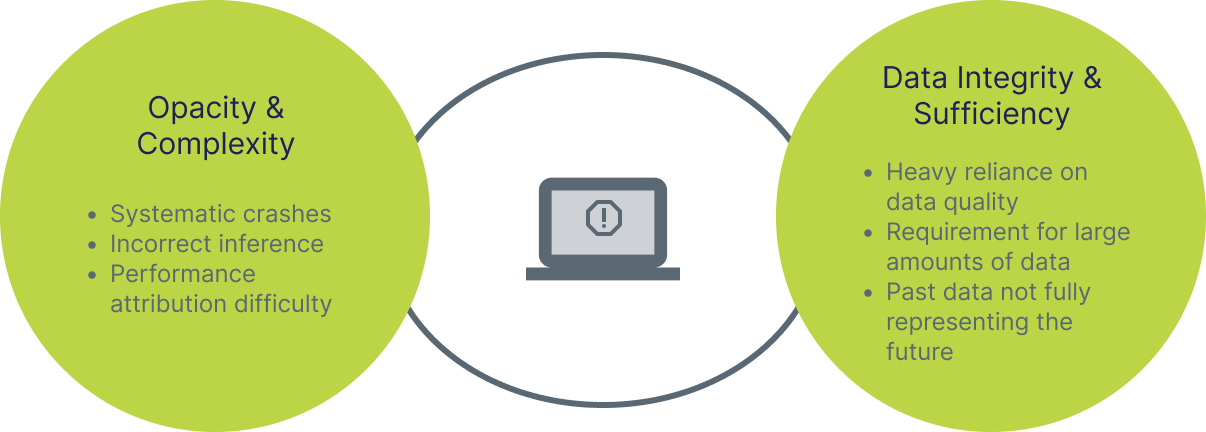

Pitfalls and Potential Concerns

AI and ML offer powerful transformative benefits but come with risks that must be understood, managed and mitigated. Issues like bias in training data, overreaction to short-term market fluctuations and the inability to predict rare events can lead to mispricing and systemic instability. Additionally, the opacity of complex models raises trust issues, while ethical concerns like herding behavior raise concerns about the amplification of market volatility. Addressing these challenges is essential to fully harnessing AI and ML in bond pricing.

- Bias in Training Data: AI/ML models rely heavily on the data they are trained on, and if this data is biased or not representative of diverse market conditions, the models’ predictions can be flawed. For example, if an AI model is trained primarily on data from a period of economic growth, it may fail to predict the risks during an economic downturn. In this case, the model might underestimate the possibility of increased credit risk, leading to an overestimation of bond prices. This could cause investors to be overly optimistic about bond performance, only to face unexpected losses when market conditions shift, such as during a recession.

- Overreaction to Short-Term Market Movements: AI models can sometimes overreact to short-term fluctuations in the market, causing excessive volatility or mispricing of bonds. For instance, if an AI model detects a minor negative movement in bond prices due to rumors or short-term sentiment shifts, it may react too strongly, amplifying the price decline. A small change in bond prices, driven by market sentiment or algorithmic trading, could lead to amplified price movements. In practice, this could lead to a situation where AI algorithms create a market sell off, causing bond prices to fall far beyond what the underlying fundamentals would justify, as seen in short-term market.

- Tail Risk and Systemic Risk: AI models often struggle to account for rare but high-impact events, known as "tail risks", leading to underpriced risks and potential systemic instability. These models may lack sufficient data on extreme events like financial crises or defaults, leaving them vulnerable when such events occur. For example, during the 2008 financial crisis, many models failed to predict the magnitude of bond price declines because they were not trained on similar extreme conditions. As a result, these models underestimated the risks associated with mortgage-backed securities and contributed to broader financial instability. Without sufficient data on such rare occurrences, AI models can misprice risk and fail to protect against major market disruptions.

- Lack of Transparency and Explainability: A significant challenge with complex AI models, particularly deep learning networks, is their lack of transparency. Often referred to as “black boxes,” these models operate in ways that are difficult to interpret, making it challenging to understand the reasoning behind their outputs. This opacity can raise trust concerns, particularly during periods of market stress. For instance, if an AI-driven model for bond pricing contributes to significant price fluctuations, the inability to explain its decisions may undermine confidence among investors. During episodes of market volatility - such as sharp movements in bond prices triggered by an economic shock - this lack of interpretability could erode trust in the model’s reliability and raise scrutiny from regulators seeking clarity on its decision-making logic.

- Market Structure Risks and Ethical Concerns: AI models also pose ethical concerns and risks to market structure, especially when many market participants rely on similar algorithms. This can lead to herding behavior, where traders make similar decisions based on the same information, amplifying market volatility. For instance, if a large number of traders use AI models that interpret the same signals as a reason to sell bonds, this collective behavior can result in a dramatic price drop. A minor economic slowdown, interpreted by many AI systems as a sign to liquidate bond positions, could cause a sell-off, exacerbating market instability. In such cases, herding behavior can lead to flash crashes and further heighten market inefficiencies.

AI Areas of Concern

How the Next Generation of AI & ML Addresses Transparency and Bias

Next-generation AI and ML are transforming bond pricing by tackling key challenges like transparency and bias.

Explainable AI (XAI): Interpretability tools such as SHAP (SHapely Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations) are helping to enhance explainability. These tools enable stakeholders to understand model outputs and attribute model predictions to specific features driving decisions.

Bias mitigation: The use of diverse datasets and bias detection algorithms are helping mitigate biases, ensuring more accurate and equitable outcomes. Bias Mitigation Techniques, such as using varied datasets, applying fairness constraints, and employing bias detection algorithms, help AI models minimize market biases. This ensures that bond pricing remains both accurate and fair, improving outcomes by reducing the risk of perpetuating systemic biases.

Hybrid models & Human oversight: Combining AI’s predictive capabilities with human oversight further promotes transparency, accountability, and balanced decision-making in complex pricing scenarios. Hybrid Models and Human Oversight ensure decisions are transparent and accountable by integrating human judgment with AI predictions. This approach is particularly effective for managing intricate pricing and risk scenarios, where human expertise is crucial to validating and refining AI outputs.

Conclusion

Accurate bond pricing remains a cornerstone of financial markets, essential for transparency, risk management, and compliance. The introduction of AI and ML is transforming the area, offering unprecedented efficiency, precision, and scalability. From predictive analytics and sentiment analysis to yield curve forecasting and real-time pricing automation, these technologies are reshaping how fixed-income securities are valued.

However, challenges persist. Risks such as bias, lack of transparency, and overreliance on models must be carefully managed to avoid mispricing and systemic instability. Emerging solutions, including explainable AI, hybrid models with human oversight, and advanced bias mitigation techniques, are helping address these concerns.

As AI and ML evolve, the path forward lies in balancing their transformative potential with a strong commitment to ethical, transparent, and responsible market practices.

About Us

RoZetta Technology’s data science team utilises advanced AI and machine learning models for predictive modelling, optimisation, and statistical data analysis in capital markets applications.

Our cloud-based platform, DataHex, centralises data access, streamlining management, entitlements, and analysis. Combined with expert advisory and tailored solutions, we empower clients with data-driven insights to enhance returns, manage risk, and stay agile in evolving market conditions.

Peter Jones

Chief Product Officer, RoZetta Technology

Email: peter.jones@rozettatechnology.com

LinkedIn: www.linkedin.com/in/peterdysonjones/

To learn more, visit us at rozettatechnology.com or email us at enquiries@rozettatechnology.com